We’ve got answers

What is financial coaching?

Financial coaching simply stated involves a relationship between a client and their coach whereby the coach walks step by step with a client providing one on one guidance, accountability and helping the client understand the concept of money management and how to develop a spending plan that truly reflects the client’s financial goals. The overall objective is to help clients develop a healthy relationship with their finances and empower them to take control of their financial life.

Why do I need a financial coach? Can I do it on my own?

A financial coach provides three major benefits that you may not be able to accomplish on your own. Insight, accountability and objectivity. A financial coach provides insight by analyzing your finances, providing an individualized strategic plan and education for your specific situation. A coach will help you glean a better understanding of the obstacles that impede you from attaining your goal, help you remove them and set you on a path to financial freedom.

A coach also provides accountability and remains a resource to keep you on track. Like a personal trainer is for your physical fitness, a financial coach is for your financial fitness giving you the tools to succeed and guiding you along the path.

In addition, a financial coach provides objectivity. Financial decisions can sometimes be difficult and emotional. A financial coach provides objectivity that will help you break free of the emotional binds and help you make objective decisions that will help lead you to your ultimate goal of financial freedom.

What is the difference between a financial COACH and a financial ADVISOR?

A financial coach is an advocate for a client who provides direct insight into how funds should be allocated to ensure the most efficient use of the client’s money based on the client’s financial goals.

Once a client feels financially empowered with his/her finances, a financial advisor can help a client with specific product recommendations or investment accounts to use to help grow their money. Often, a minimum assets level is required for a financial advisor to help provide services to clients.

“Never spend your money before you have it”

Thomas Jefferson

How can financial coaching benefit me?

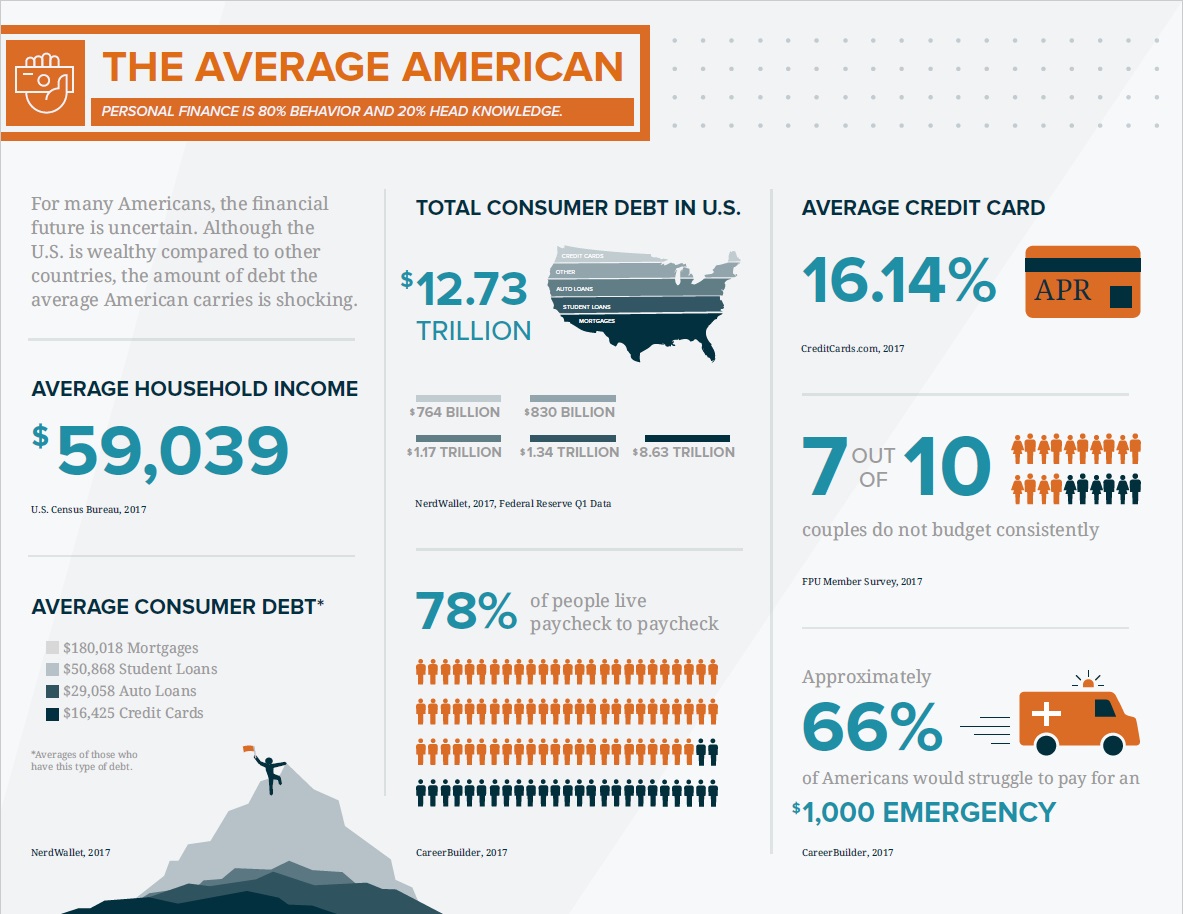

Finances play a significant role in multiple aspects of our lives. Couples argue and divorces

occur because or the lack of understanding of finances and failure to develop proactive financial goals for the family. Single parents lay awake at night in an attempt to determine how to make their finances stretch to meet the needs of their children. Singles struggle with prioritizing what is most important for them and how to allocate their funds in a way that reflects their values, wants and needs in life. Credit card debt over takes our lives and we find ourselves in an endless cycle of never being able to pay off our debt because of surmounting interest rates.

Some live in fear of a financial crisis occurring because they don’t have the financial reserves to take care of any unexpected financial needs. Others are concerned with saving for retirement and leaving a legacy for their children and generations to come. And yet still others make ‘good money’ but at the end of the day, they feel they have mothing to show for it.

If these stories resonate with your current financial reality, know that there is hope. You don’t have to live feeling ‘broke’. We can help you break the cycle and place you on a path to financial independence.

As your financial coach, at Asefo Consulting we are here to walk with you every step of the way towards your goal.

Be empowered in your finances. Take control of your money! Don’t let money take control of you.

We can help.

Here are some interesting statistics

- 7 in 10 Americans struggle with financial stability

- Only 28% of Americans consider themselves as financially healthy and have 6 months

or more of emergency savings - Most Americans would not be able to pay for an emergency expense of $1,000

- About 1 in 5 middle-class workers are spending more than they earn.

- 77% of Americans say they are stressed over finances